Table of Contents

RK Swamy Market:

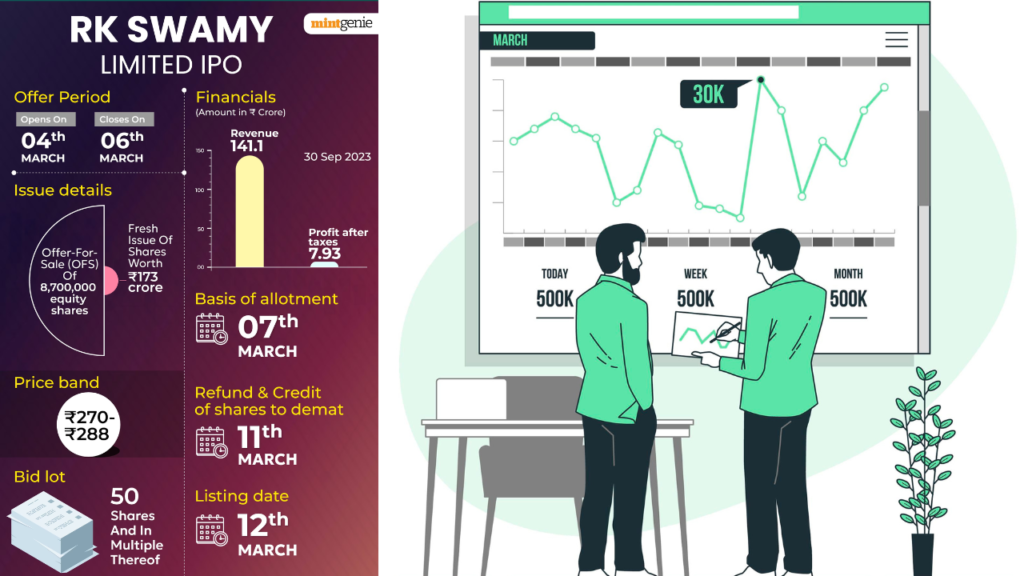

Investors have eagerly accepted the IPO of RK Swamy, a company providing integrated marketing services. Investors can bid for the shares of this issue opened today till March 6. It was completely filled within a few hours of the IPO opening. By afternoon it had received 1.49 times subscription. The company had raised Rs 187.22 crore from anchor investors even before the opening of the IPO. RK Swamy IPO is getting a lot of support in the gray market. The shares of the issue are trading at 31 percent premium in the gray market.

The company wants to raise Rs 424 crore through this IPO. The company will issue new shares worth Rs 173 crore in its IPO, while the remaining shares worth Rs 250.56 crore have been put up for sale by the promoters and shareholders of the company. In this, promoter Srinivasan will sell 17.88 lakh shares, and Narasimhan Krishnaswamy 17.88 lakh shares, investors Evanston Pioneer Fund LP 44.45 lakh shares and Prem Marketing Ventures LLP 6.78 lakh equity shares.

RK Swamy IPO Price Band:

The company has kept the price band of Rs 270 to Rs 288 per share for its IPO. At the upper price, the company is preparing to raise about Rs 424 crore from its IPO. At the same time, its total market cap at this price is estimated at around Rs 1,450 crore. Investors can bid for RK Swamy’s IPO according to the lot size. There will be 50 shares of the company in one lot. Retail investors can bid for a minimum of 1 and maximum of 13 lots.

RK Swamy GMP is showing signs of profit:

RK Swamy IPO is getting good support from the gray market. The unlisted shares of the issue are trading at a premium of Rs 90 in the gray market. In this context, IPO investors can get 31 percent listing gain and according to the upper price band, shares can be listed in the stock market at Rs 378.

RK Swamy Rating's:

Many brokerage houses have also advised to invest money in RK Swamy IPO. Canara Bank Securities has given ‘Subscribe’ rating to this IPO for listing gains. Reliance Securities has given ‘Subscribe’ rating for long term. Similarly, Anand Rathi has also advised investors to invest money in this IPO from a long term perspective.